Option selling is a trading system that sells choice agreements to different merchants. When you sell a choice, you are committed to trading the hidden resource at a predetermined cost at the very latest predefined date. This can be a dangerous system, however, it can likewise be entirely productive whenever done accurately.

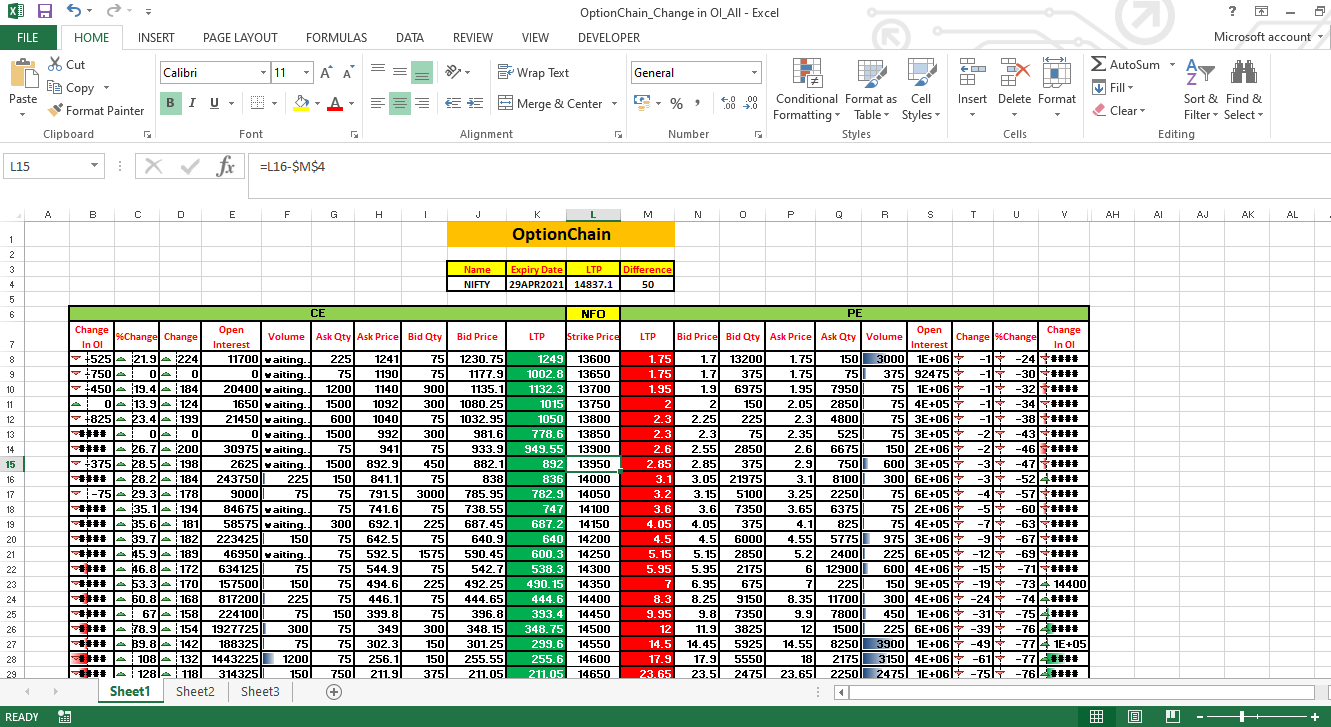

The Nifty Option Chain is a valuable asset that can be utilized to distinguish likely open doors for choice selling. The choice chain shows the strike costs, termination dates, and costs of each of the accessible Nifty Option Chain contracts. By understanding how to peruse the choice chain, you can distinguish the market’s assumptions at the future cost of the Nifty file and track down valuable chances to sell choices that will probably lose their utility.

Here is a portion of the vital things to search for in the Nifty Option Chain while considering choice selling:

Strike costs:

The strike cost is the cost at which the choice can be worked out. While selling choices, you need to pick strike costs that you are certain won’t be arrived at by the lapse date. This will assist with guaranteeing that your choices lapse useless and that you keep the exceptional you gather.

Termination dates:

The lapse date is when the choice can be worked out. While selling choices, you need to pick lapse dates that are far sufficient in the future to give the market time to move against you. This will assist with diminishing your gamble of the choice being worked out.

Suggested unpredictability:

Suggested unpredictability is a proportion of how much the market anticipates that the Nifty record should move from now on. While selling choices, you need to pick choices with high suggested instability. This is because high inferred flux implies that the trading choices are more costly, and you will gather a more significant premium when you sell them.

Open interest:

Open interest is the number of agreements that have been traded in the market. While selling choices, you need to pick a favorite with high open interest. This is because high open interest intends that there is a great deal of interest in the choice, and it will be simpler to sell it, assuming you want to.

By understanding how to peruse the Nifty Option Chain, you can distinguish possible open doors for choice selling and deal with your gamble. Here are a few explicit techniques that you can utilize:

Covered call:

A covered call is a methodology where you sell a call choice on your current stock. This is a somewhat protected system since you have the hidden resource for sell if the choice is worked out.

Bare put: A stripped put is a trading technique where you sell a put choice on a stock that you don’t possess. This is a more hazardous methodology since you are committed to purchasing the stock if the choice is worked out. Be that as it may, it can likewise be more productive, assuming the stock cost falls underneath the strike cost of the option.